Beneficiary ira rmd calculator

Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Ad Learn More About American Funds Objective-Based Approach to Investing.

Required Minimum Distribution Calculator

How is my RMD calculated.

. Get your own custom-built calculator. Beneficiary Date of Birth mmddyyyy. The account balance as of December 31 of the previous year.

When you are the beneficiary of a retirement plan specific IRS rules regulate the minimum withdrawals you must take. When you inherit an IRA from a non-spouse you have quite a. How To Calculate RMD For Inherited IRAs.

Distribute using Table I. The RMD Calculator compares the Primary Beneficiarys year of birth to the Successor Beneficiarys year of birth. If inherited assets have been transferred.

Calculate the required minimum distribution from an inherited IRA. We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. RMDs for Inherited IRAs are calculated based on two factors.

This calculator has been updated for the. The SECURE Act of 2019 changed the age that RMDs must begin. In some situations the RMD.

The FINRA Required Minimum Distribution RMD from a traditional 401 k or IRA is based on your age and account value. RMD amounts depend on various factors such as the decedents age at death the year of death the type of beneficiary the account value and more. How to calculate required minimum distribution for an IRA.

Ad The IRS Requires You Withdraw an Annual Minimum Amount From Certain Retirement Accounts. Upon the death of. Beneficiaries of a retirement plan can choose to keep the assets in a tax-deferred inherited IRA account.

Account balance as of December 31 2021. For example if you turn 72 in October 2022. With a Focus on Client Goals American Funds Takes a Different Approach to Investing.

If you were born. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death. Estimate annual minimum withdrawals you may be responsible to take from your inherited IRA using an inherited IRA RMD calculator from HF Trade.

The IRA has other tables for beneficiaries of retirement funds and account holders who have much younger spouses. Determine beneficiarys age at year-end following year of owners. Distributions are Required to Start When You Turn a Certain Age.

Calculate your earnings and more. If you want to simply take your. RMDs are also waived for IRA owners who turned 70 12 in 2019 and were required to take an RMD by April 1 2020 and have not yet done so.

FINRA RMD Calculator. Using an inherited IRA RMD calculator can help you see what you are required to withdraw so you can accurately plan your future. The difference Successor Beneficiarys year of birth - Primary.

This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. Your life expectancy factor is taken from the IRS. You may also use the IRS.

Helps IRA beneficiaries calculate the required minimum distribution RMD amount that must be withdrawn this calendar year from an inherited IRA if applicable. As a beneficiary you may be required by the IRS to take. We offer bulk pricing on orders over 10 calculators.

While alive the IRA owner begins taking RMD payments at age 72 or 70½ if born before 711949 using the Uniform Distribution Table to calculate the distribution. If you were born on June 30 1949 or earlier you were required to begin taking RMDs by April 1 following the year you reached age 70½. If you have inherited a retirement account generally you must withdraw required minimum distributions RMDs from.

If youve inherited an IRA depending on your beneficiary classification you may be required to take annual withdrawalsalso known as required minimum distributions RMDs. This calculator determines the minimum required distribution known as both RMD or MRD which is really confusing from an inherited IRA based on the IRS single life expectancy table. See When How Much You Need To Begin Withdrawing From Your Retirement Savings Each Year.

Ad Whats Your Required Minimum Distribution From Your Retirement Accounts.

Pin By Pinna Birdie On Financial Affairs In 2022 Inherited Ira Ira Roth Ira Contributions

Learn How To Calculate Online Advertising Rates To Make Money Blogging Inherited Ira Blog Advertising Money Blogging

How To Calculate Rmds Forbes Advisor

Roth Ira Calculator Roth Ira Contribution

Avoid This Rmd Tax Trap Kiplinger

Required Minimum Distribution Calculator Estimate Minimum Amount

Required Minimum Distribution Calculator Estimate Minimum Amount

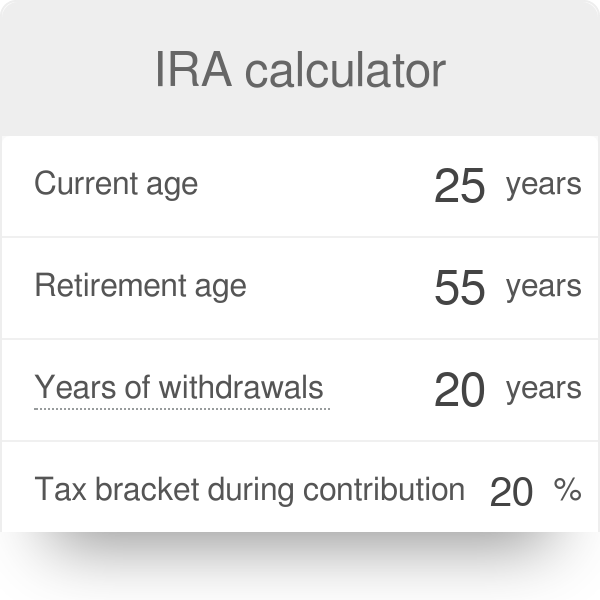

Ira Calculator

Ira Required Minimum Distribution Table Sound Retirement Planning

Calculating The Required Minimum Distribution From Inherited Iras Morningstar

Irs Proposes Updated Rmd Life Expectancy Tables For 2021 Life Expectancy Proposal Irs

Ira Future Withdrawal Calculator Forecast Rmds Through Age 113

Rmd Table Rules Requirements By Account Type

Required Minimum Distributions For Retirement Morgan Stanley

Rmd Calculators Required Minimum Distributions Charles Schwab Required Minimum Distribution Inherited Ira Financial Planner

Calculating Required Minimum Distributions For Inherited Iras Retirement Daily On Thestreet Finance And Retirement Advice Analysis And More

Rmd Calculator Required Minimum Distributions Calculator